Moldovan cabinet considers, approves notifications of MPs' amendments to fiscal, customs policy for 2021

20:16 | 14.12.2020 Category: Official

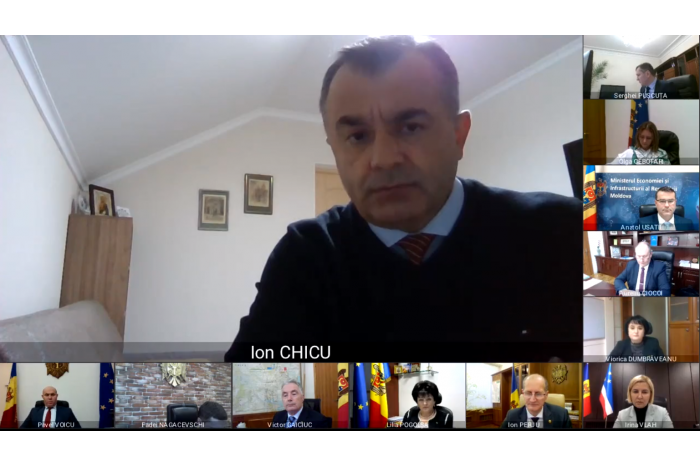

Chisinau, 14 December /MOLDPRES/ - Prime Minister Ion Chicu said that the today’s cabinet meeting was an important and special one, the government’s communication and protocol department has reported.

"The today’s meeting is dedicated to considering the amendments, preparation and approval of notifications to the amendments to the draft budgetary and fiscal laws, elaborated by the government in cooperation with the business environment, as well as with more institutions, including local public authorities, and presented it to in parliament. A period of more than ten days was provided for examination; the lawmakers had time to consider them and come up with proposals,’’ Ion Chicu said.

As for the amendments on the exclusion of measures of diminishing the circulation of cash money, the cabinet maintains its position in the context of the benefits for the society of the proposals on decreasing the payments in cash. Most European Union countries resorted to the limiting of the size of the sum which can be paid in cash.

As for the amendments concerning the system of personal exemptions, husband/wife and for the maintained people, the government’s goals and measures are aimed at backing the employment of people able for working, with the establishing of the mechanism of subsidizing the creation of jobs proposed in this respect. Also, within the fiscal reform started in late 2018, the personal exemption was essentially increased from 11,280 lei to 24,000 lei, so that the present personal exemption represents a higher value than the overall exemptions for both spouses till the reform (22,560 lei). At the same time, additional exemptions are to be preserved and, respectively, provided to the people who, due to some circumstances, are maintained by the person, given that they are unable for work (children, pensioners, disabled people, including the husband). In this respect, the cabinet proposes an increase, in an accelerated pace, of the exemption for the maintained people by 50 per cent.

Ass for the proposals related to the change of the regime of the value added tax (VAT) in agriculture, through imposing a low VAT quota for fertilizers, we mention that the proposal is partially backed through postponing the implementation of the provisions and the their entrance into force on 1 July 2021. The government reiterates that the measures of revising the current regime of imposing the VAT, related to the primary agricultural production, included in the draft, comes from the need to ensure the development and increase in the competitiveness of the native producers. As a result of analyses of policies’ options, including of the international practice, the cabinet members proposed the imposing of a low VAT quota of 12 per cent for fertilizers, simultaneously with the imposing of the same VAT quota for the primary agricultural production. Through the concerned measure, the accumulation in account of the VAT sums formed since 2010 are to be turned from debts accumulated from financial means for the native agricultural producers. At the same time, a positive effect of the measure represents the increase in the size liable to return of the VAT on the export in farming goods from 8 to 12 per cent of the exports’ value.

As far as the amendments to removal of prohibitions at the import of transport means is concerned, we mention that conceptually, the customs legislation should not see bans of goods (excepting the ones for which the circulation is prohibited in Moldova, such as the drugs), and if there is will to decrease the imports of certain goods for ecological reasons, they should be made by imposing increased taxes. In this respect, concomitantly with the elimination of prohibitions, decision-makers propose essentially increase in the excise duties proportionally to the period of exploitation of the transport means. The existence of prohibitions creates stimuli for illicit activities, through which both the bans and the payment of taxes is avoided. Also, they do not allow the development of businesses, the goal of which is the import, processing and export of the concerned goods.

As for the proposals regarding the adjusting of the legislation on the tobacco products, the parliament is to decide on the maintaining or excluding of the notion from the draft law and, respectively, on the taxation regime.

As for the proposals dealing with the extension of the duty-free shops, the government does not back the concerned amendment, as this runs counter the EU standards and generates the cut in the budget revenues. The cabinet deems as important the reiteration of the negative impact of the proposals on the climate of loyal competition in the native environment, as well as the country’s image internationally.

As for the amendment concerning the exclusion of the airport tax, it is not supported, as this represents a source of financing for the fund of social support of the residents and, respectively, will hit the financing of programmes with special purpose in the social assistance sector.

As for the amendments concerning the capping of local taxes, the cabinet members propose the maintaining of the government’s position. The economic development and, respectively, the ensuring of the budgetary sustainability, both at the central and local levels, is made by tax payers, who assume all entrepreneurship risks. Or, the lack of fiscal certainty and predictability strongly influences the investment decisions of the business environment. It is worth mentioning that the size of the local taxes was established, so that the impact on the incomes of the local authorities is reduced to the minimum.

Also, the cabinet backs the amendment on introducing a one-off allowance worth 100,000 lei for the staff of the medical and sanitary institutions, who died in the fight against COVID-19.

The government also supports the amendment on the introduction of the specific increase worth 40 per cent to the staff of the authority in charge of the constitutionality control. Additionally, the cabinet proposes the completion of the Law No 270/2018 on the single salary payment system in the public sector with norms, in order to distinguish the levels of salary payment in the local public authorities in the settlements with less than 5,000 residents and eliminating the discrepancies in the payment of salaries of the heads of the public sector units, which are structural subdivisions of the deliberative representative authorities of the second level, through giving the right to benefit from stages of salary payment.

The PM thanked the business environment, MPs and associations for efficient cooperation and communication in the working out of draft laws.

"I want to thank the business associations, citizens, authorities, who contributed to the elaboration of these drafts. The Finance Ministry, since last September, has submitted for consultations the proposals for the budgetary and fiscal policy; we can deem the draft presented in parliament as a result of the joint work with representatives of the business environment.

I want to thank the colleagues, who during the last days have considered the amendments submitted by MPs and worked out the draft notifications. I want to thank also the lawmakers who focused on the substance, not the content of the laws and contributed to the improvement of these drafts,’’ Ion Chicu said.

photo: Government