More than 460,000 income declarations submitted to Moldova's State Fiscal Service till 2 May 2019

13:47 | 30.05.2019 Category: Economic

Chisinau, 30 May /MOLDPRES/ - The State Fiscal Service (SFS) today informed that it had finished the action of processing data on the submission of the declarations on income tax for 2018, with 468,276 declarations submitted by tax payers received and processed till 2 May 2019.

According to data provided by SFS, 320,515 declarations on income tax were submitted by private people, up by 110, 065 declarations against the same period of 2017. The increased number of declarations submitted was prompted by the amendments made to the fiscal policy, which entered into force as of 1 October 2018. Only two per cent of them were submitted on paper and the rest – in electronic format.

Information declared at SFS shows that the sum of incomes got by private persons in 2018 amounts to 59.58 billion lei and the income tax paid to the budget is of 4.53 billion lei. The indexes are increasing by 11 per cent against the ones recorded for 2017. Respectively, the sum of average income of a tax payer is of 49,700 lei in 2018 against 44,800 lei in 2017.

Also, the State Fiscal Service informed that it had identified 1,760 Moldovans who in 2018 earned incomes worth more than one million lei. The largest sum got by a private person in 2018 was of 83.25 million lei. Most millionaires are registered in Chisinau – 1,384. The youngest person of this category is 21 years old and the oldest one – 90 years.

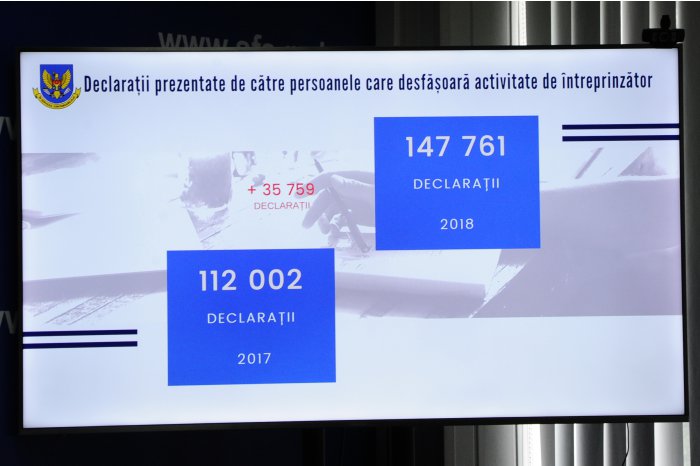

At the same time, the State Fiscal Service found out an increase in the number of income declarations submitted by legal entities. As many as 147,761 declarations were received for the 2018 fiscal period, which is by 32 per cent more against the period of 2017.

Data unveiled by economic agents for the 2018 fiscal period shows that they recorded incomes amounting to 382.5 billion lei and expenses worth 357.2 billion lei. The incomes grew by 14.1 billion lei and the expenses – by 14.7 billion lei against the year before.